NYC Property Tax Information

NYC Real Estate taxes are calculated on the assessed value assigned by local governments. Generally, the NYC property tax rate per month for Manhattan real estate is approximately 0.075% and for Miami it is 0.2%. Since Miami does not have an income tax, its property tax rates are higher than in New York.

Manhattan Property Tax Abatements- 421a and 421g

421(a) Tax Abatement

What is a 421a Tax Abatement? One thing that NYC investors and residents love is the 421(a) tax abatement, which was offered to apartment owners of certain buildings built from 2005 to 2008. The 421a tax abatement provides for a steep reduction in taxes for investors in new developments that were built between 2005 and 2008. A common question from individuals looking to invest in NYC real estate is how to calculate a 421a Tax Abatement. Here is how it works: Every two years, property taxes rise by 20% of the normal tax rate until the 11th year when the tax becomes the normal rate. Take for instance, a 1-bedroom apartment that costs $900,000 and would have a normal tax of approximately $900 per month.

- In the first two years of the abatement, the property tax will be a nominal

amount of about $60 per month.

- After the second year, the tax will rise to $180 (20% of the $900).

- After the fourth year, the tax will rise to $360 (40% of the $900).

- After the sixth year, the tax will rise to $480 (60% of the $900) and so on and

so on, until the 11th year, when the tax rate will rise to the $900 (or whatever

the normal tax rate is at that time).

421(g) Tax Abatement

The 421g tax abatement is very rare and only applies to select new buildings in the Financial District below Murray Street in NYC. A 421g abatement provides for NO property taxes for the first 10 years and then reduced taxes for the remaining four years.

- 11th year, the tax amounts to 20% of the normal tax.

- 12th year, the tax amounts to 40% of the normal tax.

- 13th year, the tax amounts to 60% of the normal tax.

- 14th year, the tax amounts to 80% of the normal tax.

- 15th year, the tax amounts to 100% of the normal tax.

Recent Changes to the NYC Mansion Tax and Transfer Taxes

Come July 1, 2019, closing costs for buyers in NYC will be rising via an increase in the mansion tax, a one-time real estate transfer tax similar to stamp duty in other countries. Currently, cash buyers of properties $1 million or more incur total closing costs of approximately 2.5% of the purchase price. Of which, 1% is the mansion tax.

The new legislation will increase, on a graduated scale, the mansion tax for properties over $2 million. There will be no increase up to $2 million, a slight increase (0.25%) from $2 - $3 million and then another slight increase (0.75%) from $3 - $5 million. The increases are more significant as the purchase price increases with a top rate of 4.15% for properties over $25 million. Here is the full table of rates:

$1 - $2 million = 1%

$2 - $3 million = 1.25%

$3 - $5 million = 1.75%

$5 - $10 million = 2.5%

$10 - $15 million = 3.5%

$15 - $20 million = 3.75%

$20 - $25 million = 4%

$25+ million = 4.15%

In addition, the seller’s closing costs will be rising slightly as well. For properties $3 million or more, the new combined New York State and City transfer tax will rise to 2.075% up from 1.825%.

Overall, we don’t expect these NYC real estate tax increases to have any real discernible impact on the market. Compared to other countries, our closing costs are relatively low, even with these increases. New York City’s property tax and closing costs are not meant to be a barrier to entry on the market.

Miami Property Tax Information

When owning real estate in Miami, bona fide Florida residents receive a $25,000 exemption for their primary residence under the Homestead Exemption Act. While residents still pay property taxes, the assessed value is reduced by $25,000 before the tax is calculated. More importantly, the Homestead Exemption limits property tax increases, which is the true value of this exemption for property taxes Miami.

"Miami Luxury Real Estate Tax Information You Should Be Aware Of"

Capital Gains Taxes

The difference between the selling price and the basis of the property is defined as a capital gain. The US government imposes a 20% tax on this gain for US residents (assuming the property was owned for more than one year). If the gain is greater than $250K, there is an Obamacare surcharge of 3.6%. For Foreign Nationals, depending upon the US tax treaty with the buyer’s home country and the structure that they use to hold the property, the tax can range from 21% to 23.8%.

$250,000 EXCLUSION ON SALE OF PRIMARY HOME

For US residents, individuals can exclude up to $250,000 in profit from the sale of a primary home (or $500,000 for married couples), as long as the home was owned and lived in by the individual (or couple) for two out of the last five years. If you lived in the home for less than two years, you may be able to exclude a portion of the gain. Exceptions are allowed if you sold your house because the location of your job changed, because of health concerns or as a result of other unforeseen circumstances (as defined by the IRS).

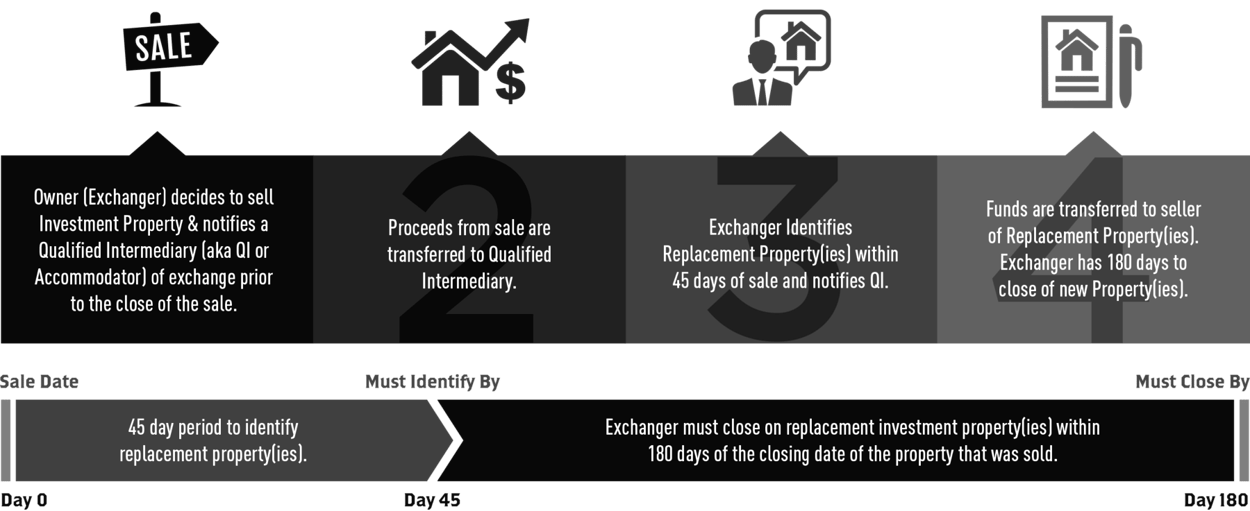

Section 1031 – Capital Gains Tax Deferral on Investment Property

A 1031 Exchange is known as a tax-deferred exchange. Under Section 1031 of the Internal Revenue Code, an investor can defer the capital gains tax by exchanging one investment property for another, as long as the two properties meet the “like-kind” property definition in the code. The owner would sell their property and within a specific number of days, identify and then purchase and close the transaction on another property. The rules are very strict, so they must be followed exactly. See the 1031 Exchange Rules – Capital Gains Tax Deferral page for more detailed information on this topic.

No Income Tax for the first 10 to 15 Years

When Financing Real Estate Purchases

Foreign Buyers who finance their purchases with a 40% to 50% down payment will likely not pay income taxes for the first 10 to 15 years, as the US government is very generous when it comes to those expenses that are allowed to be deducted from rental income. Since mortgage interest, common charges, property taxes, depreciation of the asset over 27.5 years, insurance, and amortization of closing costs are all deductions against income, in the early years the property will generate negative taxable income. In future years, when the apartment is generating taxable income, the income can be offset by prior year negative taxable income (a.k.a. tax loss carry forward). This results in no income taxes for many years. See the Cost Components of a Real Estate Investment section of this website for further information. Foreign Buyers must make a timely election to offset rental income with expenses otherwise they will be charged a flat rate of 30% on total receipts. Therefore, even in the early years, when the investment is making tax losses and the foreign buyer will owe no taxes on the rental income of the property, he or she must file timely income tax returns so the election is in place.

FOREIGN INVESTMENT IN REAL ESTATE PROPERTY TAX ACT (FIRPTA)

When a non-resident sells US property, the Internal Revenue Service wants to be sure they get paid capital gains taxes. Accordingly, the IRS withholds 10% of the gross purchase price of the property. When a US tax return is submitted reporting the capital gains tax, if there is any refund due, that money will be refunded to the filer. This can be avoided if the foreign buyer makes a 1031 Exchange.

Foreign Buyers Must Plan to Avoid The US Estate Tax

When a Foreign Buyer dies, his or her estate will be taxed by the US government at close to 45%. This is easily avoided if the foreign buyer does some upfront planning. The planning involves setting up a Limited Liability Corporation (LLC) and a Foreign Corporation. The LLC would own the property, the Foreign Corporation would own the LLC, and the buyer would hold shares of stock in the Foreign Corporation. Under this scenario, since the property is “owned” by the Foreign Corporation, the US government would receive nothing upon the death of the Foreign Buyer. This is a great tax savings for Foreign Buyers and is not very expensive to implement.

It is advisable for any owner of investment real estate in the US to create at least an LLC to hold the asset, since the buyer’s liability would be limited to the value of the asset (as the LLC would not hold any other property or assets). Taking this one step further by using a Foreign Corporation to own the LLC would provide protection to the Foreign Buyer against the estate tax.

If a Foreign buyer does not want to maintain the LLC and the Foreign Corporation (perhaps because the investment is small), an alternative approach would be to obtain term life insurance to cover the equity in the property (market value less remaining mortgage). A healthy 38-year-old man or woman who buys a 10-year term life policy would pay $650 per year for each $1 million of coverage (or $500K equity). We consider this a very cheap hedge to escape the effects of the estate tax without setting up the foreign corporation structure. While the foreign owner would not avoid the estate tax, his or her heirs would be made whole from the insurance proceeds.

Foreign Parents Buying Property For Children

A lot of our foreign clients have been buying properties for their children who are either working or going to school in the United States. Accordingly, the question of whether parents buying for children might cause a taxable event in the US has come up often.

Unfortunately, the gifting of property to your child would be considered a taxable event to the recipient. In addition, the sale of shares in an LLC to a child would also constitute a taxable event. In contrast, however, the sale of shares of a foreign corporation to your child would not constitute a taxable event, so one could transfer shares to a child this way. However, the structure is a bit complicated and not advantageous in terms of capital gains tax. There's other routes to avoid being taxed and to learn more about that just sign up below.

-2.png?width=500&height=205&name=MIAMI%20HOME%20SEARCH%20(2)-2.png)